Have you ever felt that the world of cryptocurrencies is like an exclusive club where only experts enter? The reality is that thousands of ordinary people are taking advantage of this digital revolution to build wealth, and the surprising thing is that many started with no prior knowledge. The difference between those who succeed and those who fail is not in complex strategies, but in mastering the basic fundamentals that few explain to you properly.

The Ultimate Guide to Taking Your First Steps in Cryptocurrencies

To invest in cryptocurrencies you don't need to be a financial genius. What you do need is a clear plan and an understanding of the basics. This guide will take you step by step from zero to your first investment.

Before you continue, remember the golden rule that even Warren Buffett would apply to the crypto world: “Never invest money you can't afford to lose”. Cryptocurrencies offer great opportunities, but they also carry significant risks.

Why Invest in Cryptocurrencies in 2025?

Cryptocurrencies represent a new digital asset class with unique characteristics:

- Decentralization: They do not depend on banks or governments

- Transparency: All transactions are verifiable

- Accessibility: You can start with minimal amounts

- Growth potential: Many have multiplied their value in short periods

As Michael Saylor, CEO of MicroStrategy, pointed out: "Bitcoin is the first scarce, decentralized, public and global digital currency in human history". This innovation represents a historic opportunity for investors of all levels.

How much money do I need to invest in cryptocurrencies?

One of the great advantages of cryptocurrencies is their fractionalization. You can invest from as little as:

- 10€ in most popular exchanges

- 25€ if you want to diversify in several currencies

- 50-100€ to create a balanced initial portfolio

Contrary to popular belief, you do not need to buy a full Bitcoin (which can cost tens of thousands of euros). You can buy small fractions, even 0.0001 BTC.

The ideal amount depends on your personal financial situation, but experts recommend starting with a small percentage of your available capital (between 1-5%) until you become familiar with how the market works.

Safe Platforms to Buy your First Cryptocurrencies

To invest you need access to a cryptocurrency exchange. These are platforms that work as intermediaries to buy and sell digital assets.

The most recommended for beginners because of their ease of use and security are:

- Coinbase: Intuitive and educational interface

- Binance: Greater variety of cryptocurrencies and low fees

- Kraken: Excellent security and customer service

- Bitvavo: Popular in Europe with competitive rates

- Bit2Me: Spanish option with support in Spanish

To open an account you will need to:

1. Register with your email

2. Verify your identity (KYC process)

3. Connect a payment method (card or transfer)

4. Make your first purchase

Security tip: Always enable two-factor authentication (2FA) to protect your account.

How to Securely Store Your Cryptocurrencies

Once you have purchased your cryptocurrencies, secure storage is crucial. There are two main types of wallets:

Hot Wallets

Connected to the internet, they offer greater accessibility:

- Exchange wallets: Convenient but less secure

- Mobile apps: Like Trust Wallet or Exodus

- Browser extensions: Like MetaMask to interact with DApps

Cold Wallets

Physical devices that store your keys outside the internet:

- Ledger Nano: S and X Series

- Trezor: Greater security for significant investments

For small investments (less than 500€), a mobile wallet with good security measures may be sufficient. For larger amounts, a hardware device is practically mandatory.

Vitalik Buterin, creator of Ethereum: “You don't own your cryptocurrencies if you don't own your private keys”.

Strategies for Investing in Cryptocurrencies with Little Money

Starting with a limited budget is not an impediment to build a solid portfolio:

1. Average Cost Approach (ACM)

Consists of investing small amounts on a regular basis (weekly or monthly) regardless of the price. This strategy:

- Reduces the impact of volatility

- Removes the pressure to "get" the perfect timing right

- Builds investor discipline

2. Smart Diversification

Spread your investment across different categories:

- 20-30% in mid-cap altcoins

- 10-20% in smaller promising projects

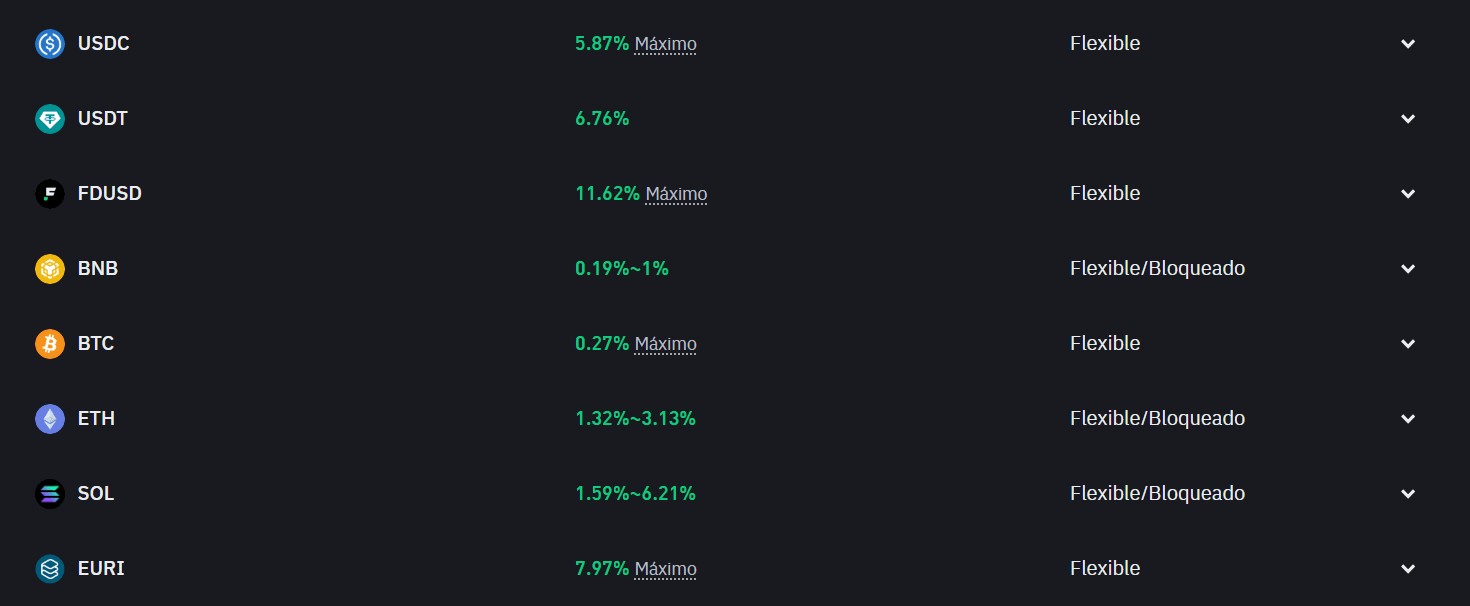

3. Staking and Passive Yield

Some cryptocurrencies allow you to generate passive income:

- Ethereum (ETH) offers staking with returns of 3-5% per year

- DeFi platforms can offer higher returns, although with higher risk

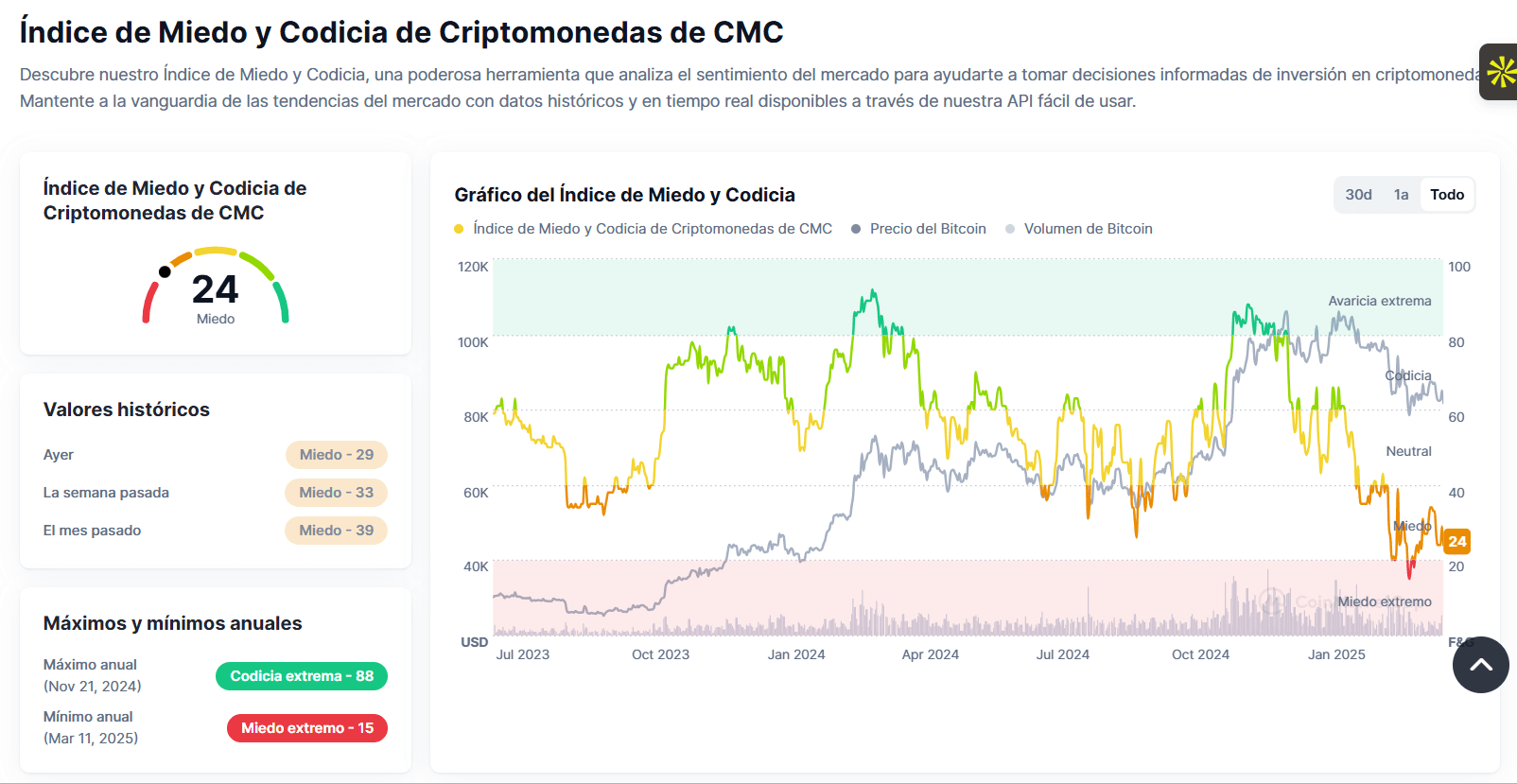

When is the right time to invest in cryptocurrencies?

Perfect timing is impossible even for experts. However, you can follow these principles:

- Fundamental Research: Evaluate the project, team and use case

- Basic Technical Analysis: Identify general market trends

- Market Cycles: Cryptocurrencies have historically shown 4-year cycles

The most important thing to understand is that investing after large rallies increases risk, while correction periods offer better entry points.

Benjamin Graham, mentor to Warren Buffett: “The market is a machine for transferring money from the impatient to the patient.” This applies perfectly to the volatile cryptocurrency market.

The Risks and Benefits of Investing in Cryptocurrencies

Potential Benefits

- High Yield: Possibility of significant gains

- Diversification: Low correlation with traditional assets

- Technological Innovation: Exposure to disruptive technologies

- Financial Inclusion: Access to global financial services

Risks to Consider

- Extreme Volatility: Dramatic price fluctuations

- Security: Risk of hacks and scams

- Regulation: Unpredictable regulatory changes

- Loss of keys: Without access to your keys, you lose your funds

Mitigating these risks is possible with ongoing education, proper diversification and robust security measures.

How to Train in the World of Cryptocurrencies

Self-study is essential for success in this dynamic space:

Recommended Resources:

- Books: "Mastering Bitcoin" by Andreas Antonopoulos, "The Bitcoin Standard" by Saifedean Ammous, Cryptocurrencies for dummies by Carlos Callejo and Victor Ronco.

- Educational platforms: Binance Academy, Coinbase Learn

- YouTube channels: Coin Bureau, Whiteboard Crypto

- Podcasts: What Bitcoin Did, Unchained

- Communities: Reddit (r/cryptocurrency), Discord of specific projects

Spend at least 2-3 hours a week on your crypto education. This knowledge is the best protection against bad investment decisions.

Is it profitable to invest in cryptocurrencies over the long term?

Historical returns have been extraordinary for patient investors:

- Bitcoin has outperformed all other assets over the past decade

- Bullish cycles have led to returns in the thousands of percent

- Even in bearish periods, the long-term trend has been positive

However, past performance does not guarantee future results. The key is to develop a customized strategy that aligns with your financial goals and risk tolerance.

Raoul Pal, former Goldman Sachs fund manager: "Cryptocurrencies are the most asymmetric investment opportunity I've seen in my entire career.

1. Start with the basics: Bitcoin and Ethereum before exploring less established projects

2. Document everything: Keep records of your investments for tax purposes

3. Ignore the noise: Most short-term predictions are useless

4. Stay informed: Don't invest in projects you don't understand

5. Be patient: The best returns come with time and discipline.