Imagine you're at an amusement park, riding roller coasters that go up and down at high speed. That's what it feels like to invest in cryptocurrencies. In this world, excitement is constant, but so are the risks. If you're thinking about investing, you need to know the strategies that will help you navigate this thrilling yet often unpredictable market. Ready to learn how to make your investment safer and more profitable?

Why Invest in Cryptocurrencies?

The Opportunity

Cryptocurrencies have gained popularity due to their potential for significant returns. Unlike traditional investments, cryptocurrencies offer unique opportunities:

- High Returns: Some investors have multiplied their money in a short time.

- Diversification: Investing in cryptocurrencies allows you to diversify your portfolio.

- Global Access: Anyone with an internet connection can participate.

The Risks

However, it’s essential to understand that this potential comes with risks. Cryptocurrency markets are volatile, meaning prices can change rapidly. This is where the right strategies come into play.

Strategies for Investing in Volatile Markets

1. Continuous Education

Before you start investing, it's crucial to educate yourself about the market. This includes:

- Reading Books and Articles: Familiarize yourself with the basics of cryptocurrencies and blockchain.

- Following the News: Stay updated on trends and regulatory changes.

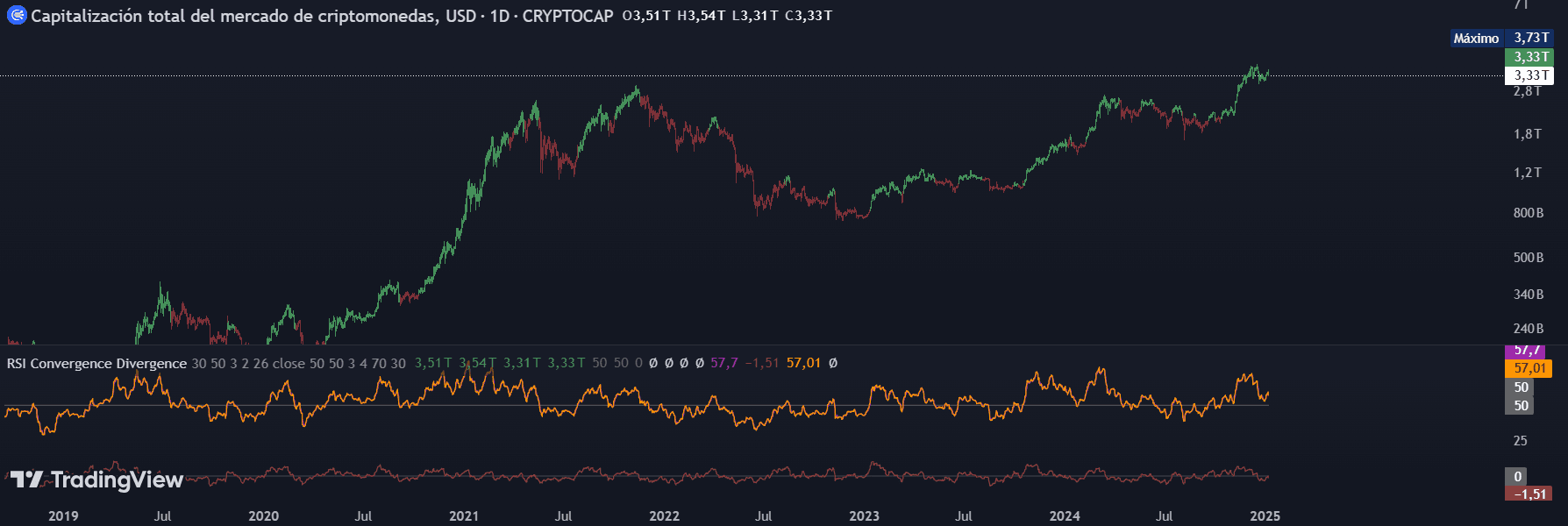

2. Technical Analysis

Technical analysis involves studying price charts to predict future market movements. Useful tools include:

- Candlestick Charts: These show the open, close, high, and low of an asset over a specific period.

- Relative Strength Index (RSI): This indicates whether a cryptocurrency is overbought or oversold.

Here you can find a guide on technical analysis for beginners.

3. Portfolio Diversification

Don’t put all your eggs in one basket. Diversifying means investing in different cryptocurrencies and other assets, which helps reduce risk.

- Large-Cap Cryptocurrencies: Such as Bitcoin and Ethereum.

- Altcoins: Lesser-known coins with growth potential.

4. Long-Term Investment

Long-term investing means holding your assets for an extended period. This strategy allows you to avoid daily volatility and benefit from long-term growth.

- Buy and Hold: Acquire cryptocurrencies and keep them, ignoring day-to-day price fluctuations.

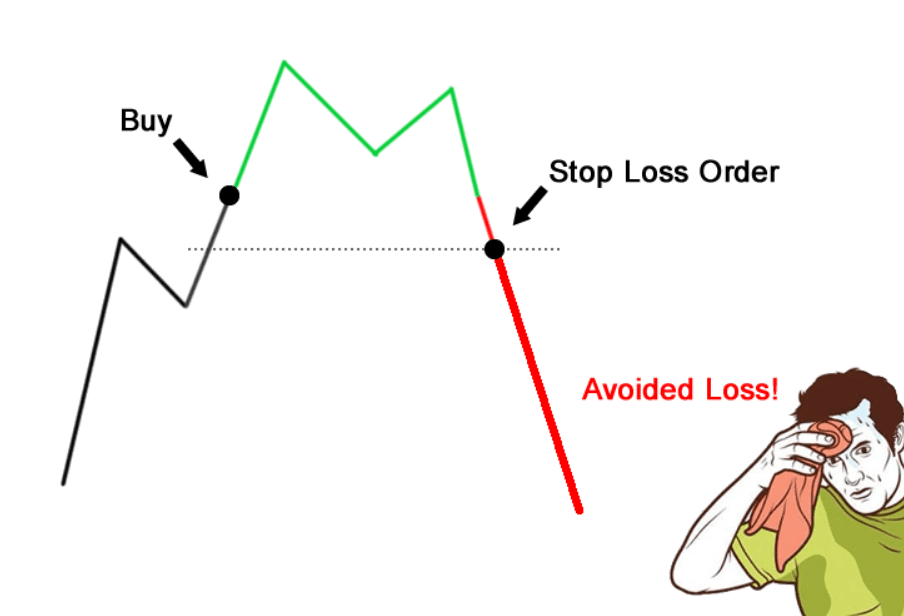

5. Use of Stop-Loss

A stop-loss is an order to sell a cryptocurrency when it reaches a specific price. This helps limit your losses.

- Example: If you buy a cryptocurrency at $100 and set a stop-loss at $90, it will automatically sell if the price drops to that level.

6. Short-Term Trading

If you are comfortable with risk, short-term trading can be profitable. This involves buying and selling cryptocurrencies in a short period to take advantage of price fluctuations.

- Day Trading: Buying and selling cryptocurrencies on the same day.

7. Stay Emotionally Detached

Impulsive decisions are the enemy of a good investor. Stay calm and stick to your strategy, even when the market is volatile.

- Write an Investment Plan: Define your goals and strategies in advance.

Tools for Investing in Cryptocurrencies

Cryptocurrency Exchanges

Use secure and reliable trading platforms to buy and sell cryptocurrencies. Some popular ones are:

Digital Wallets

A digital wallet is where you store your cryptocurrencies. There are several types:

- Cold Wallets: Offline, safer for storing large amounts.

- Hot Wallets: Connected to the internet, easier for daily transactions.

Legal and Tax Considerations

It’s important to be aware of the laws governing cryptocurrencies in your country. This includes capital gains tax and usage regulations.

- Consult an Advisor: Consider speaking with an expert to better understand your tax obligations.

Conclusion

Investing in cryptocurrencies can be an exciting and potentially rewarding experience. Knowing the right strategies is key to navigating volatile markets. From continuous education to portfolio diversification, every step counts.

Remember that while the opportunities are great, so are the risks. Stay informed and adjust your strategies according to market behavior. Ready to begin your journey in the world of cryptocurrencies? The adventure is just beginning!