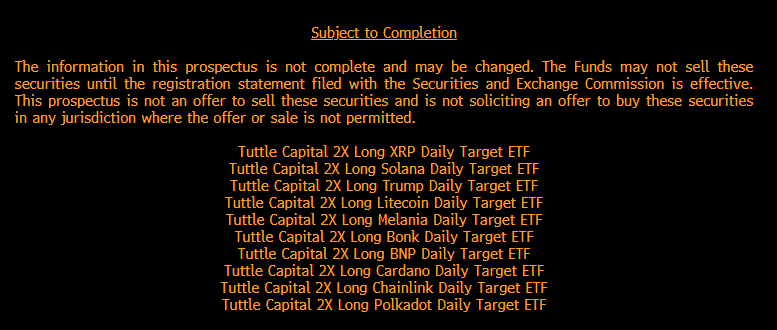

Tuttle Capital files for leveraged ETFs targeting memecoins, including TRUMP and MELANIA, along with 8 other crypto assets such as Cardano, XRP, and Polkadot.

These ETF filings come as the SEC undergoes a restructuring with the arrival of pro-crypto chairman Mark Uyeda, who replaces Gary Gensler, making the approval of such ETFs under the Trump administration more feasible.

In this regard, renowned analyst James Seyffart stated on his X account, “This is a case where issuers are testing the limits of what the SEC will allow. I expect that the new cryptocurrency task force (led by Hester Peirce) will likely be the key to determining what will be permitted and what will not.”

Tuttle Capital's filing includes exposure to major cryptocurrencies such as Solana, XRP, Litecoin, and Cardano, in addition to meme coins like TRUMP, MELANIA, and BONK.

The filing for these leveraged ETFs is unusual, as typically, non-leveraged ETFs are filed first, followed by their leveraged versions.

In this case, the leverage is set at 200%, meaning higher returns if cryptocurrencies rise, potentially doubling the investment within the ETF. However, it also doubles the losses, implying that in the event of a 50% drop, investors could lose their entire capital.

Eric Balchunas, Bloomberg analyst, noted

A 2x filing before a 1:1 exposure ratio is unusual. The filing is under the 40 Act and could be in the market by April unless the SEC rejects it.

These ETFs could be approved by the SEC, but it's important to note that memecoins like TRUMP and MELANIA, which are more volatile and immature, could be impacted by this and may not have their ETFs launched. In contrast, cryptocurrencies like Cardano, Polkadot, XRP, or Solana, being more mature assets, are likely to see a clearer approval for their ETFs.