In the dynamic world of cryptocurrencies, staking and mining have become two popular strategies for generating passive income.

The crypto universe is constantly evolving, and more people are seeking alternatives to capitalize on their cryptocurrency investments.

Before we dive in, imagine growing your investments without having to buy expensive equipment or worry about energy consumption. Sounds interesting, right? Keep reading to discover how each method can be tailored to your needs and expectations.

What Is Cryptocurrency Staking?

Staking is a process in which certain cryptocurrencies are "locked" in a digital wallet to participate in transaction validation and the maintenance of the blockchain network. This method is based on the Proof of Stake (PoS) mechanism, which, unlike mining, requires very low energy consumption.

How Staking Works

- Locking Cryptocurrencies: When you stake, you deposit a specific amount of cryptocurrency into a designated wallet, committing it to the network for example can be Metamask.

- Transaction Validation: Your participation helps to confirm and validate transactions on the blockchain better known as nodes.

- Steady Rewards: In return, you receive rewards in the form of additional tokens or cryptocurrencies, regularly and proportional to the amount staked.

Vitalik Buterin, Ethereum’s co-founder, has emphasized that staking not only improves network efficiency but also contributes to a more sustainable ecosystem.

What Is Cryptocurrency Mining?

Mining is the process by which transactions are validated and the integrity of the blockchain is ensured. Miners use specialized equipment to solve complex mathematical algorithms, which allows new blocks to be added to the chain in exchange for cryptocurrency rewards. Learn here how to mine Ethereum or Bitcoin for beginners.

How Mining Works

- Solving Algorithms: Equipment such as ASICs, GPUs, etc., compete to solve mathematical problems.

- Confirmation and Recording: Once the algorithm is solved, the block is added to the blockchain, thereby confirming the transactions.

- Block Rewards: The miner who solves the problem receives a reward, which can be significant depending on the network and the hardware used.

Investopedia highlights that mining is crucial for the security and transparency of blockchain networks, as it ensures the veracity of every transaction.

Key Differences Between Staking and Mining

To understand which method best suits your needs, it is essential to compare staking and mining across several aspects.

Validation Mechanism

Staking:

- Based on PoS (Proof of Stake).

- Depends on the amount of cryptocurrency locked.

- A passive process that does not require solving complex algorithms.

Mining:

- Based on PoW (Proof of Work).

- Requires solving intensive mathematical problems.

- Involves active competition among miners to be the first to validate a block.

Investment and Costs

Staking:

- Low Initial Investment: All you need is a digital wallet and an internet connection.

- Reduced Operating Costs: No need for expensive equipment or high energy consumption.

Mining:

- High Initial Investment: Requires purchasing specialized hardware (ASICs, GPUs, etc.).

- High Energy Costs: Electricity consumption can significantly affect profitability.

Profitability and Scalability

Staking:

- Stable Passive Income: Rewards are regular and predictable.

- Easy to Scale: Accessible for any user without advanced technical knowledge.

Mining:

- Potential for High Returns: Can offer higher gains, but depends on equipment efficiency and energy costs.

- Increased Competition: Profitability may be affected as more miners join the network.

Associated Risks

Staking:

- Fund Lock-Up: Your assets remain locked during the staking period.

- Network Dependency: Failures or changes in the network can affect rewards.

Mining:

- Hardware Obsolescence: Technology can become outdated quickly.

- Energy Cost Fluctuations: Increases in electricity prices can render mining unprofitable.

Is mining or staking more profitable? The answer depends on your profile, resources, and risk tolerance. If you prefer a simple, low-energy method, staking is ideal. On the other hand, if you have the investment and technical know-how, mining could offer higher returns, albeit with more risks.

Is Mining or Staking More Profitable?

Profitability is one of the most debated aspects of these two strategies. Each method has its advantages and limitations:

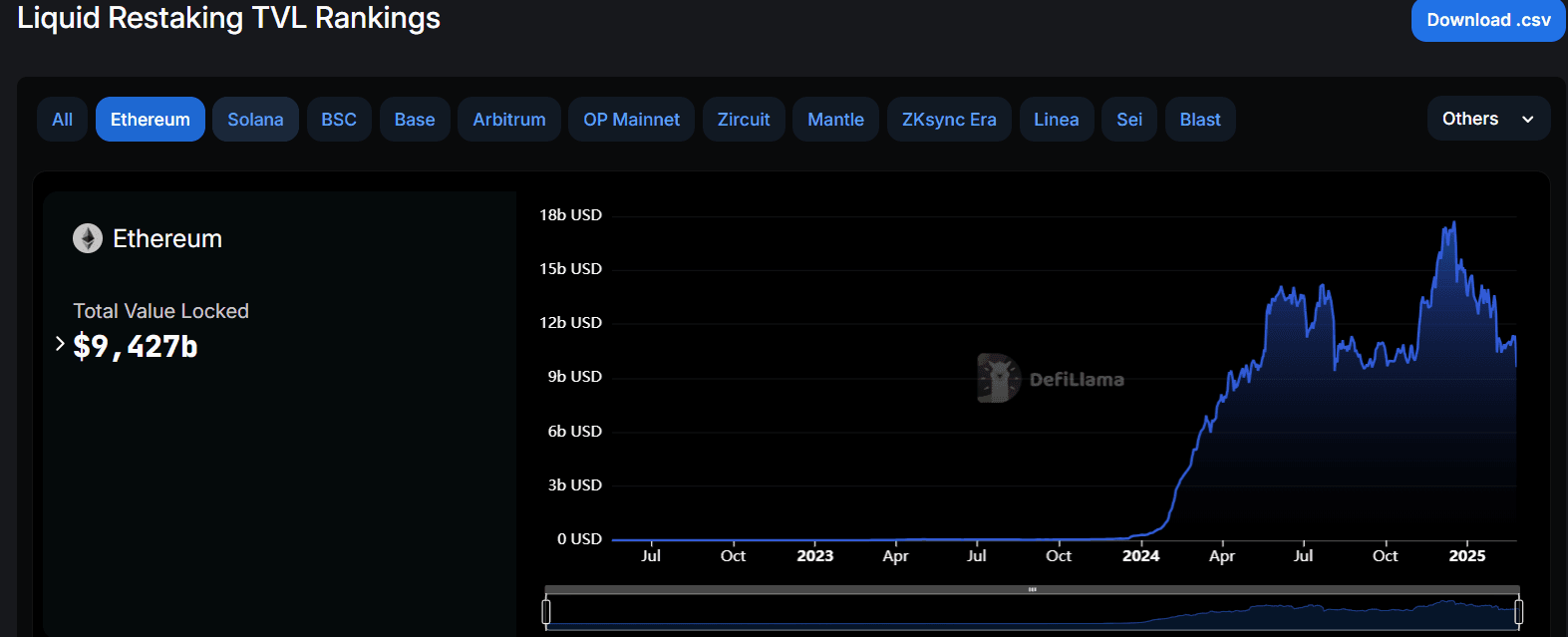

Profitability of Staking

- Consistent Rewards: Staking provides regular passive income.

- Lower Cost Volatility: Not affected by energy prices or hardware obsolescence.

- Relevant Examples: Networks like Cardano (ADA) and Polkadot (DOT) have proven to offer good returns to users who stake or you want to learn how to staking with Solana in Phantom here is a step by step guide.

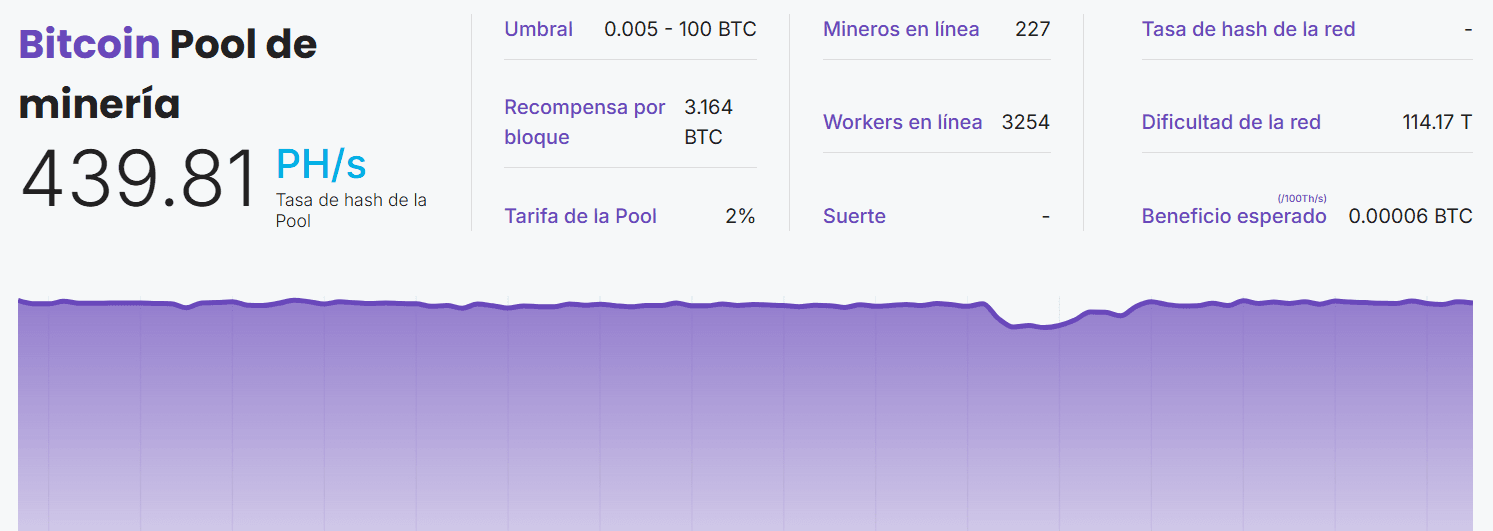

Profitability of Mining

- Potential for High Gains: During periods of high demand, mining can generate significant returns.

- Reliance on External Factors: Success depends on hardware efficiency and energy costs.

- Practical Example: Bitcoin mining, although highly competitive, has been very lucrative for those who optimize their equipment and reduce operating costs.

Technical and Operational Requirements

Before diving into either strategy, it is important to understand the technical requirements involved.

Requirements for Staking

- Digital Wallet: You need a wallet compatible with the cryptocurrency you wish to stake.

- Internet Connection: Essential for keeping your node online and synchronized.

- Staking Platform: Some cryptocurrencies require the use of specific platforms or staking services offered by reputable exchanges.

Requirements for Mining

- Specialized Hardware: Depending on the cryptocurrency, you may need high-performance ASICs or GPUs.

- Adequate Infrastructure: Good ventilation and cooling systems are essential to avoid overheating.

- Mining Software: Tools that allow you to manage and monitor your equipment’s performance.

- Reliable Power Supply: Electricity costs are crucial for calculating profitability.

Risks and Challenges

Both strategies come with risks that should be carefully considered before investing.

Risks of Staking

- Fund Lock-Up: During the staking period, you cannot access your cryptocurrencies.

- Network Changes: Updates or modifications to the protocol can alter profitability.

- Platform Dependency: Using third-party staking services requires trust in the platform’s security and stability.

Risks of Mining

- High Initial Investment: The purchase of hardware and ongoing maintenance costs can be significant.

- Increased Competition: The more miners there are, the lower the individual gains.

- Technological Obsolescence: Rapid industry evolution can render your equipment outdated quickly.

- Energy Cost Variability: Fluctuations in electricity prices can drastically affect your profit margins.

Andreas Antonopoulos in Coindesk recommends a detailed evaluation of costs and benefits before investing in mining, considering both the initial investment and operational expenses.

Success Stories and Expert Opinions

Numerous real-life cases and opinions from influential figures help shed light on how these strategies perform.

Relevant Examples

- Staking in Emerging Networks:

Projects like Cardano (ADA) and Polkadot (DOT) have enabled many users to achieve steady returns without the need for costly equipment.

- Mining in Established Cryptocurrencies:

Although Bitcoin mining requires a significant investment, many investors have obtained considerable benefits by optimizing their operations and efficiently managing energy costs.

Vitalik Buterin

He has mentioned on several occasions that the future of cryptocurrencies lies in more sustainable models, emphasizing the benefits of staking to improve network scalability and efficiency.

Andreas Antonopoulos

This renowned cryptocurrency expert stresses that the key to choosing between staking and mining is a clear understanding of your objectives, available resources, and risk tolerance. Both strategies have their place in the ecosystem, but the choice should be based on your individual profile.