Have you ever wondered how some investors achieve significant returns in decentralized markets? The key lies in the advanced investment strategies they utilize within the DeFi ecosystem. In this article, we will explore best practices and approaches to maximize your opportunities in an ever-evolving financial landscape.

Advanced Investment Strategies

1. Yield Farming

What is Yield Farming?

Yield farming involves providing liquidity to a DeFi protocol in exchange for rewards, usually in the form of tokens. This strategy can offer significant returns, but it also comes with risks.

How to Implement Yield Farming:

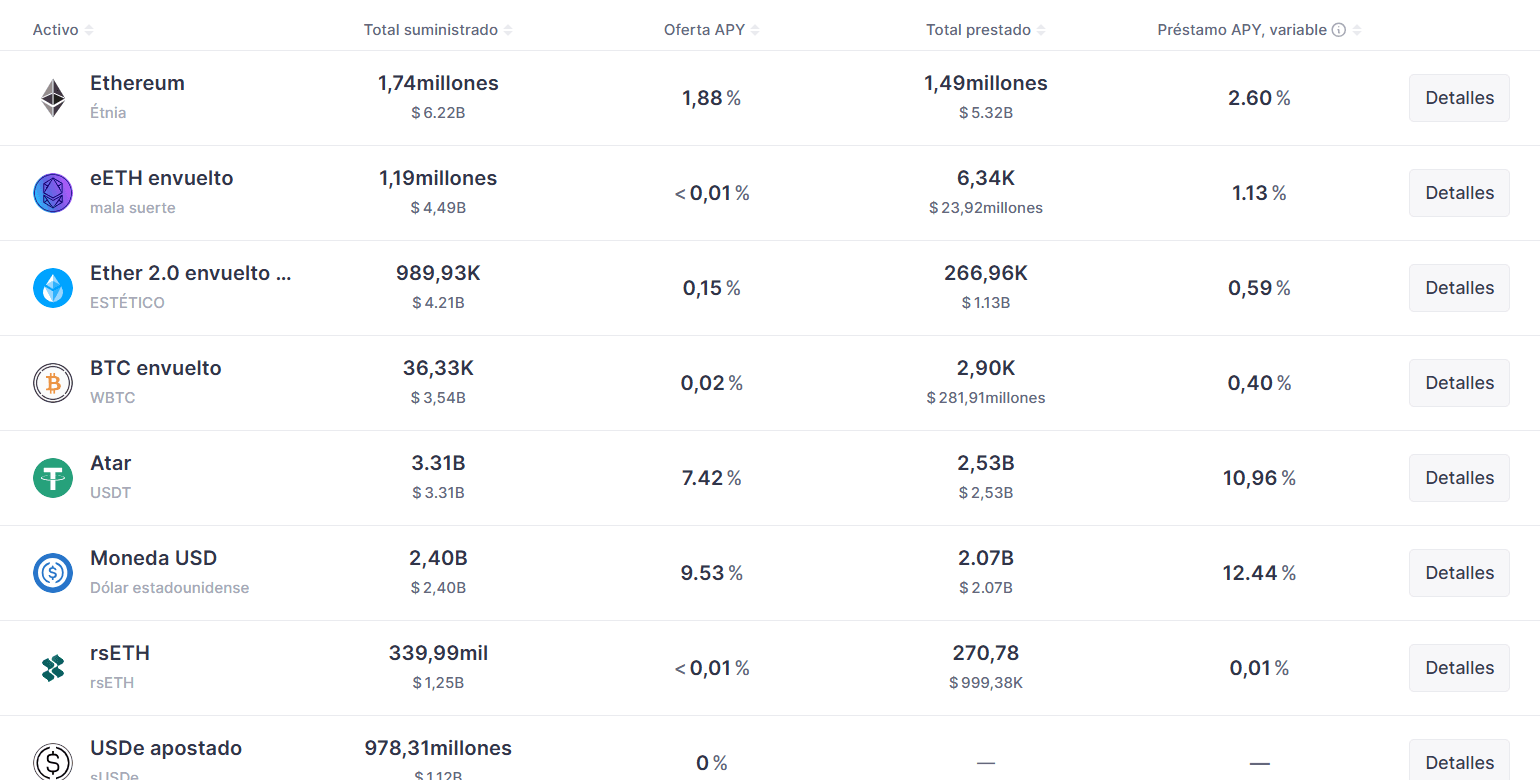

- Research popular yield farming platforms like Aave, Compound, or Yearn.finance.

- Start with a small amount of capital to familiarize yourself with the process.

- Diversify your investments across different liquidity pools to minimize risks.

2. Staking

What is Staking?

Staking is the process of holding funds in a wallet to support the security and operations of a blockchain network. In return, users receive rewards.

How to Stake:

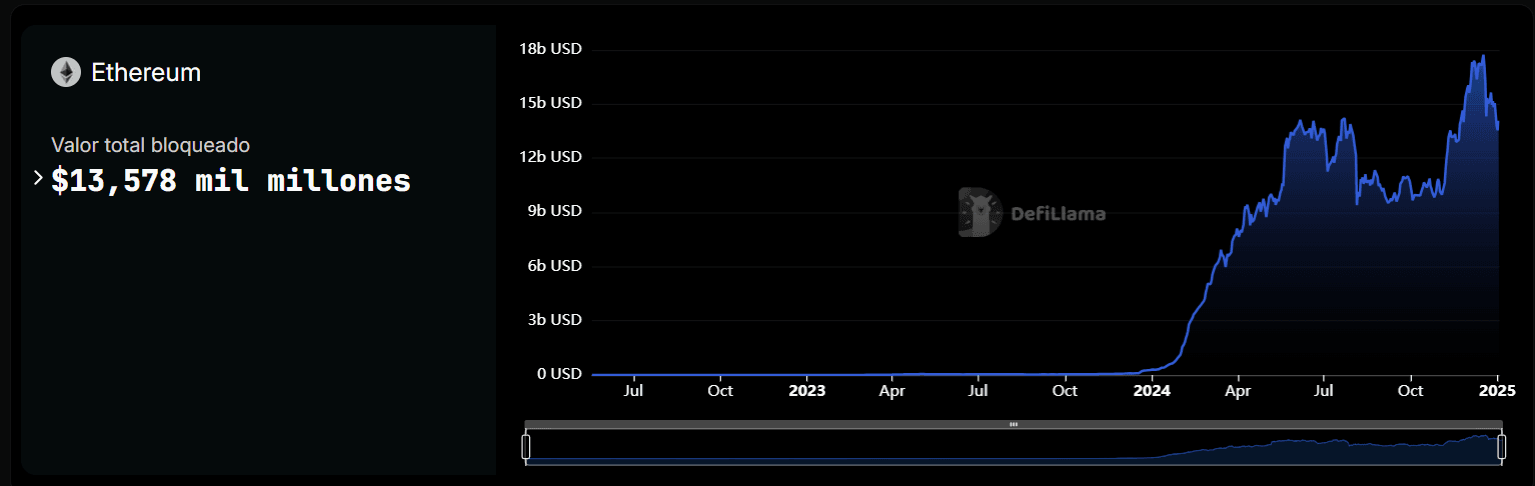

- Choose a cryptocurrency that offers staking, such as Ethereum 2.0 or Cardano.

- Ensure you understand the network requirements, such as the minimum amount of tokens needed.

- Consider the associated risks, such as the potential for losing funds due to network failures.

3. Arbitrage

What is Arbitrage?

Arbitrage involves buying an asset at a lower price in one market and selling it at a higher price in another. This strategy can be especially effective in decentralized markets due to price discrepancies between platforms.

How to Implement Arbitrage:

- Monitor different platforms to identify price discrepancies.

- Use market analysis tools to quickly spot opportunities.

- Keep transaction fees in mind, as they can affect your profit margin.

4. Providing Liquidity

What is Providing Liquidity?

Providing liquidity to a cryptocurrency pair on a decentralized exchange (DEX) like Uniswap or SushiSwap involves depositing funds into a liquidity pool. In return, liquidity providers receive fees from each transaction made in the pair.

How to Provide Liquidity:

- Research popular pairs and their transaction volumes.

- Calculate the risks of impermanent loss, which occurs when the price of the assets changes significantly.

- Monitor your investments and adjust your positions based on performance.

Important Considerations

Assessing Risk

Investments in decentralized markets are inherently risky. It is crucial to evaluate your risk tolerance and never invest more than you are willing to lose.

Stay Informed

The DeFi space is constantly changing. Stay updated on the latest trends and market news. Follow experts on Twitter, read blogs, and join online communities.

Diversification

Don’t put all your eggs in one basket. Diversifying your investments across different assets and platforms can help mitigate risks and capitalize on various opportunities.

Conclusion

Investing in decentralized markets can be an exciting and lucrative experience, but it requires a strategic approach. From yield farming and staking to arbitrage and providing liquidity, there are many ways to maximize your returns in the DeFi ecosystem. By educating yourself and applying advanced strategies, you will be better prepared to navigate this new and dynamic financial landscape. The decentralized finance revolution is here, and you can be a part of it!