Imagine being able to divide a property, a piece of art, or even a video game into small parts that you can buy and sell. This is what is known as tokenization. But what does it really mean, and how can you invest in this new and exciting concept? In this article, we will explore tokenization in depth, its function, and how you can start investing, especially if you're a beginner. Keep reading to find out!

What is Tokenization?

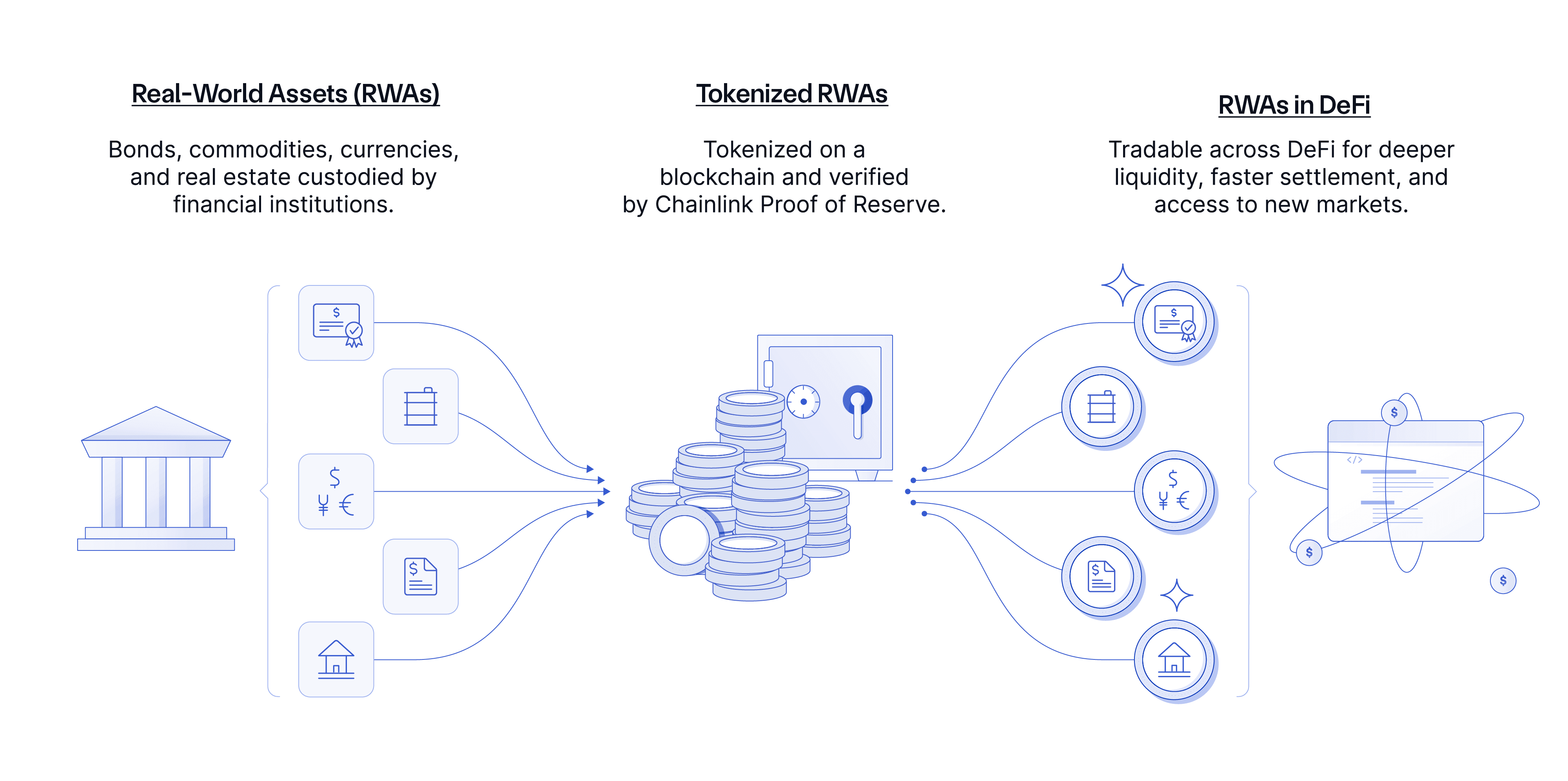

Tokenization is the process of converting a physical or digital asset into a digital token that represents a portion of that asset on a blockchain. This process allows assets to become more accessible, fractionalized, and easier to trade.

Why is Tokenization Important?

Tokenization is revolutionizing how we think about ownership and investment. Some benefits include:

- Accessibility: It allows more people to invest in assets that are traditionally difficult to acquire.

- Liquidity: It facilitates the buying and selling of assets that would otherwise be illiquid.

- Transparency: Transactions are recorded on a blockchain, providing a high level of transparency.

How Does Tokenization Work?

To understand how tokenization works, it’s important to know some key concepts.

1. Blockchain

Blockchain is a decentralized ledger technology that stores information in blocks. Each block is linked to the previous one, creating a chain. This ensures that the information is immutable and accessible.

2. Tokens

Tokens are digital units that represent an asset on the blockchain. They can be fungible (like cryptocurrencies) or non-fungible (like NFTs).

3. Tokenization Process

- Asset Identification: First, an asset is chosen to be tokenized, such as property, art, or company shares.

- Token Creation: A digital token is created on the blockchain that represents a fraction of the asset.

- Distribution: Tokens are distributed to investors, who can buy or trade them.

Types of Assets That Can Be Tokenized

Tokenization is not limited to one type of asset. Here are some examples:

1. Real Estate

Tokenizing real estate allows multiple investors to own a portion of a property without having to buy it entirely.

2. Art

Artists can tokenize their works, allowing collectors to purchase a fraction of a piece of art without spending large sums of money.

3. Company Shares

Companies can tokenize their shares, making it easier for investors to buy parts of the company rather than whole shares.

4. Digital Products

Video games and other digital products can also be tokenized, allowing players to buy and sell items within the game.

How to Invest in Tokenization

If you're interested in investing in tokenization, here are some steps you can follow:

1. Education and Understanding

Before investing, it’s crucial to understand how tokenization works. Read articles, watch videos, and participate in forums.

2. Choose an Investment Platform

There are several platforms that allow you to invest in tokenized assets. Research and choose one that fits your needs. Some popular options include:

- Real Estate Platforms: For investing in tokenized real estate.

- Art Platforms: For investing in tokenized art.

- Crypto Exchanges: For tokens related to cryptocurrencies.

3. Create a Digital Wallet

You will need a digital wallet to store your tokens. Make sure to choose a secure and user-friendly wallet.

4. Start Investing

Once you have your wallet and have chosen a platform, you can begin to invest. Start with small amounts and diversify your investments.

Risks Associated with Tokenization

Like any investment, tokenization comes with its risks. Some of them include:

1. Market Volatility

Tokenized assets can be highly volatile, meaning their value can fluctuate dramatically.

2. Regulation

The regulation of tokenization is still developing. Changes in laws may affect the value of your investments.

3. Security

While blockchain is secure, tokenization platforms may be vulnerable to hacks and fraud.

Tips for Beginners

If you’re new to the world of tokenization and investing, here are some tips:

1. Start Small

Don’t invest more than you’re willing to lose. Start with small amounts and gradually increase as you become more comfortable.

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Invest in different types of assets to reduce risk.

3. Stay Informed

The world of tokenization is constantly evolving. Stay updated on the latest news and trends.

Tokenization is changing the way we think about investment and ownership. It offers exciting opportunities to access assets that were previously difficult to acquire. While there are risks involved, with the right education and strategy, you can start exploring the world of tokenization safely. Now that you know what tokenization is, how it works, and how to invest in it, you're ready to take the next step in your investment journey!