Have you ever wondered why the price of a cryptocurrency goes up or down? One of the most important factors influencing price is market capitalization. In this article, we’ll explore what market capitalization is, how it affects cryptocurrency prices, and why understanding this concept is vital for anyone interested in investing in cryptocurrencies. Keep reading to unlock the key to better understanding the market!

What is Market Capitalization?

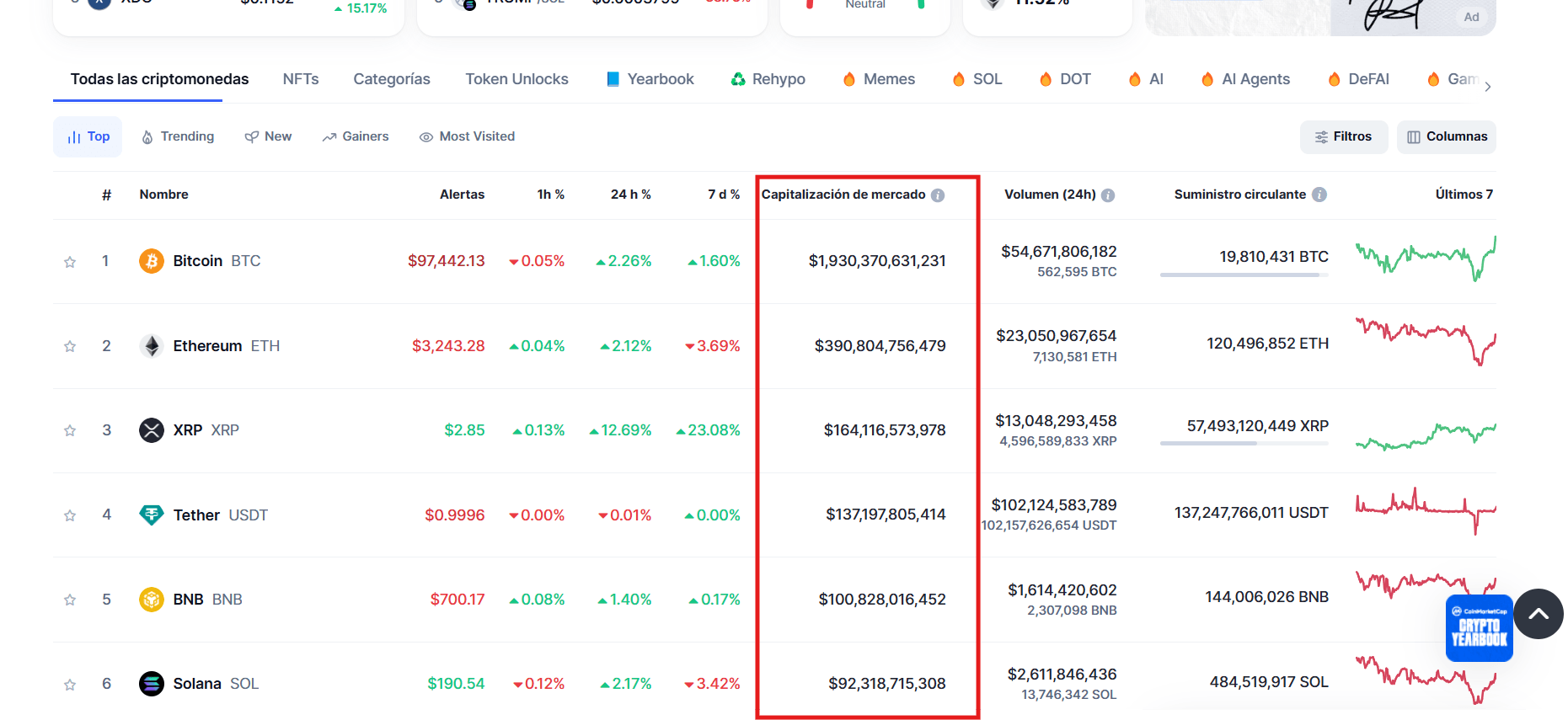

Market capitalization refers to the total value of all circulating coins of a particular cryptocurrency. It is calculated by multiplying the total number of coins in circulation by the current price of one coin. For example, if there are 1 million coins of a cryptocurrency and each coin costs $10, the market capitalization would be $10 million.

Market Capitalization Formula

Market Capitalization=Cryptocurrency Price × Circulating Supply.

This means that market capitalization not only reflects the price but also the quantity of coins available in the market.

Why is Market Capitalization Important?

Indicator of Size and Stability

Market capitalization is a key indicator for evaluating the size and stability of a cryptocurrency. Cryptocurrencies with high market capitalization, like Bitcoin and Ethereum, tend to be more stable than those with lower capitalization. This is because a larger number of investors and a higher transaction volume usually create a more robust market.

Comparison Between Cryptocurrencies

Market capitalization also allows investors to compare different cryptocurrencies. A cryptocurrency with a high market capitalization may be considered safer compared to one with a lower capitalization. Thus, by analyzing market capitalization, investors can make more informed decisions.

How Does Market Capitalization Affect Cryptocurrency Prices?

Direct Relationship

Market capitalization and cryptocurrency prices are intrinsically linked. When the demand for a cryptocurrency increases, the price goes up. This, in turn, raises the market capitalization. If the supply remains constant, an increase in demand will lead to a price increase.

Volatility in Low Market Cap Cryptocurrencies

On the other hand, cryptocurrencies with low market capitalization are more susceptible to drastic price changes. Because the transaction volume is lower, even a small increase or decrease in demand can cause significant price fluctuations. This can be attractive for traders looking for quick profit opportunities but also entails a higher risk.

Events That Can Affect Market Capitalization

Several factors can influence the market capitalization of a cryptocurrency, including:

- Update Announcements: Developers announcing improvements to the network can attract new investors, driving up price and market capitalization.

- Regulations: News about government regulations can affect the perception of a cryptocurrency, influencing its demand and, consequently, its market capitalization.

- Market Sentiment: General interest in cryptocurrencies can be influenced by news, social media, and other forms of communication, thereby affecting prices.

How to Evaluate Market Capitalization

Cryptocurrency Classification

Cryptocurrencies are usually classified into three categories based on their market capitalization:

1. Large-Cap Cryptocurrencies: These have a market capitalization of over $10 billion. Examples include Bitcoin and Ethereum.

2. Mid-Cap Cryptocurrencies: These range between $1 billion and $10 billion. They tend to be more volatile than large-cap cryptocurrencies.

3. Small-Cap Cryptocurrencies: These have a market capitalization of under $1 billion. They may present growth opportunities but carry higher risk.

Tools for Measuring Market Capitalization

Several online tools and platforms allow investors to track the market capitalization of various cryptocurrencies. Some of the most popular include:

- CoinMarketCap: Offers real-time data on prices, market capitalization, and trading volume.

- CoinGecko: Provides more detailed analysis, including community and developer information.

Investment Strategies Based on Market Capitalization

Long-Term Investment

For investors looking for stability, focusing on large-cap cryptocurrencies can be a good strategy. These cryptocurrencies tend to be less volatile and can offer steady growth over time.

Active Trading

For those interested in short-term trading, low-cap cryptocurrencies can offer significant opportunities. However, it is crucial to consider the associated risks and be prepared for rapid price fluctuations.

Conclusion

Market capitalization is a fundamental concept in the world of cryptocurrencies that directly affects the price and stability of each coin. By understanding how it works, you can make more informed decisions on your investment journey.

Ready to dive deeper into the fascinating world of cryptocurrencies? The key is to keep learning and exploring!